Ethiopia Gambling Tax Changes Could Shift Players to Unlicensed Platforms

Ethiopia’s latest overhaul of its gambling tax system has triggered concern among industry observers, who warn the changes could drive players toward offshore betting platforms and undermine the very revenue goals the reforms were meant to achieve.

Betrush, a global platform covering analysis and insights on regulated and emerging gaming markets, highlighted in a report that the government’s new tax system carries ‘layered implications.’ Under Proclamation No. 1395/2025, which came into effect in July, the government raised the withholding tax on gambling winnings covering sports bets, lotteries, and prize draws from roughly 15 percent to between 20 and 25 percent. Licensed gaming companies are also required to continue paying a 15 percent turnover tax on total wagers or ticket sales.

Officials argue the move is designed to increase public revenue and strengthen oversight in a market that has expanded rapidly thanks to mobile internet access and a youthful population. With a population of over 130 million, nearly half of whom are under the age of 20, and as one of Africa’s fastest-growing digital economies, Ethiopia has become an attractive hub for regional betting operators. Authorities say the higher taxes will ensure that more of the profits from gaming stay within the country and contribute to national development. They also aim to curb problem gambling and bring greater accountability to a sector that has grown faster than its regulatory framework.

Read Also: Booming Games Establishes Strategic Partnership with Sportpesa

Industry experts, however, caution that higher taxes could produce the opposite effect. Because bettors will now receive smaller net payouts, many may seek out offshore or unlicensed platforms that offer better odds and untaxed winnings.

Smaller local operators may also struggle to absorb the combined burden of withholding taxes, turnover levies, and compliance costs. Larger international brands, with deeper capital reserves, are expected to adapt more easily potentially leading to market consolidation and the exit of smaller competitors.

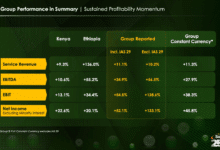

The Ethiopian approach mirrors similar debates in neighboring countries. Kenya, for instance, introduced a 20 percent tax on winnings in 2021 but later revised some provisions after operators complained of falling turnover. South Africa maintains a more moderate provincial system, where taxes on winnings generally range between 6 and 15 percent.

Analysts suggest Ethiopia’s long-term success will depend on whether regulators can strike a balance between taxation and competitiveness. Studies by H2 Gambling Capital and other market researchers indicate that an effective gaming tax structure typically keeps the total burden below 25 percent of gross gaming revenue to discourage offshore leakage.