Africa Records World’s Highest Stablecoin-to-Fiat Conversion Costs, Report Finds

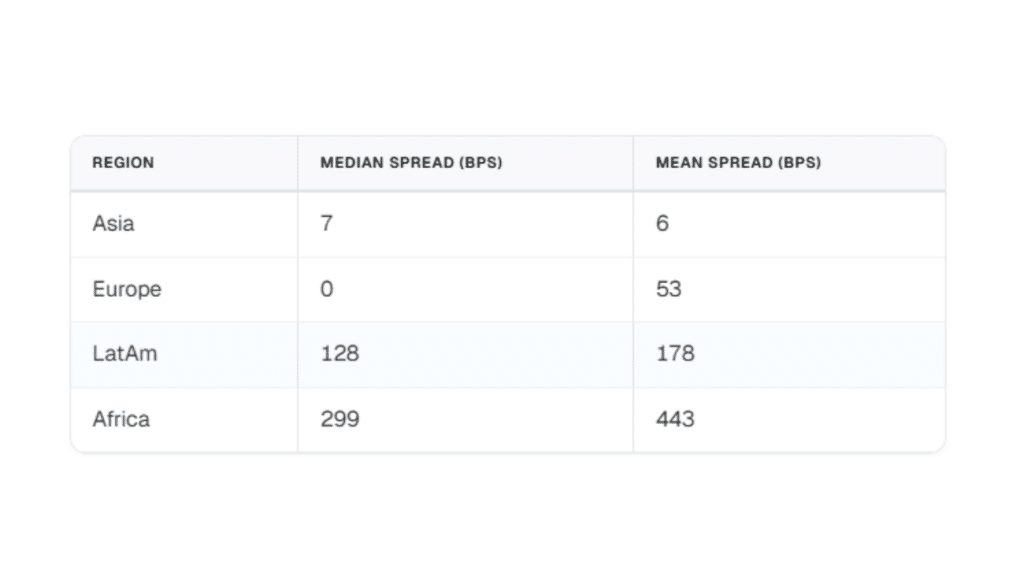

African markets stand out as the most expensive for stablecoin-to-fiat conversions, with recent data revealing dramatic disparities across the continent. In January 2026, Africa recorded the highest median spreads among all tracked regions, reaching up to 19.4% in some markets. The regional median spread was 299 basis points (about 3%), far surpassing Latin America at 1.3% and Asia at just 0.07%.

The findings, based on nearly 94,000 rate observations across 66 currency corridors, including data from 13 African countries, highlight a significant 13-fold variation in conversion costs across the continent. At this level, Africa’s costs are 2.3 times higher than those in Latin America and 44 times higher than in Asia, illustrating the considerable volatility and expense faced by users. These insights are from the latest report by the payments infrastructure company Borderless.xyz.

The report identifies local provider competition as the primary driver behind these pricing disparities. In deeply competitive markets with multiple providers, such as South Africa, conversion costs remained relatively low, at approximately 1.5% (152 bps). However, in countries where a single provider dominates, such as Botswana and Congo, costs frequently exceeded 13%, with Congo’s CDF at 1,311 bps, and Botswana hitting a continent-high of 1,944 bps earlier in the month.

Meanwhile, Nigeria (NGN), Kenya (KES), and Ghana (GHS), the continent’s largest economies and key stablecoin markets, have currency spreads around 300 bps due to multiple providers. The CFA franc zones show a split: Cameroon’s XAF at 513 bps compared to Côte d’Ivoire’s XOF at 594 bps. This 81 bps difference is likely caused by varying provider routing and local infrastructure, even though both countries use the same currency. Malawi’s currency spread is 296 bps, primarily impacted by a US dollar shortage and reliance on foreign exchange reserves. In Zambia, costs can vary by up to 650 bps, and in Tanzania, they can differ by around 310 bps, depending on the provider. Additionally, many African currencies depend on a single provider, making them vulnerable to outages.

The report also analysed the TradFi premium, the difference between stablecoin exchange rates and traditional interbank foreign exchange (FX) rates. While stablecoin rates were largely in line with traditional FX globally, Africa showed a median premium of 119 basis points (1.2%). In extreme cases like Congo, the premium reached 3,436 bps over interbank rates, reflecting a reliance on parallel market dynamics rather than competitive pricing.

Traditional transfer services in the region can still cost roughly $6 per $100 sent, making stablecoins a potentially faster and cheaper alternative in some corridors. Ultimately, the data indicates that there is no single African stablecoin market but rather 13 distinct local markets driven by internal conditions rather than continental factors. While stablecoins offer faster settlement and potential savings over legacy services, the last mile cost of converting them into local fiat remains a significant hurdle for users in less competitive corridors.