Betting Sites in Kenya Announce a 12.5% Excise Duty on Casino Bets

Betting sites in Kenya have announced a 12.5% excise duty on casino stake amounts and a further 20 percent withholding tax on casino winnings.

The move comes days after the high court determined the constitutionalism of the housing levy, among other provisions contained in the Finance Bill 2023, a good number of which touch on the betting subject matter.

Later this year, the finance committee revised the proposed increase in excise duty on betting in the Finance Bill 2023. The initial recommended rate of 20 percent was revised to 12.5 percent later this year. Prior to the introduction of the new tax, the betting duty was set at 7.5 percent.

Additionally, the legislation proposed several suggestions. These include implementing a housing levy equating to 1.5% of gross pay, imposing a 5% tax on digital creators, and raising the betting and insurance withholding tax rates to 12.5% and 16%, correspondingly. Furthermore, it entailed increasing the value-added tax on petroleum products from 8% to 16%.

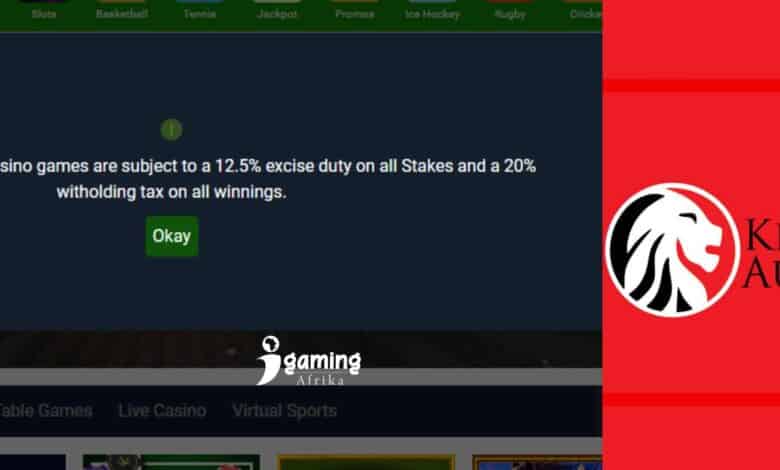

iGaming AFRIKA has since established that several betting companies in Kenya have announced to their customers that casino stakes are subject to a 12.5% excise duty, further compressing the amounts wagered by players. Furthermore, a 20% withholding tax is charged on winnings.

Read Also: Kenya Lawmakers Introduce Changes to Address Cryptocurrency Taxation

A notification from a provider in Kenya who is already implementing the excise duty on casino bets read.

“Dear Valued Customer, your balance is Ksh 100.25. Due to Excise Duty, you can only place a casino stake of upto Ksh 90.11.”

The high court judges, on November 29th, 2023, not only ruled on the constitutionality of the housing levy as stated in the Finance Bill 2023 but also affirmed the constitutionality of the 16 percent VAT on insurance premiums, the digital asset tax, and the betting tax. They stated that these taxes were in line with the Parliament’s authority.

“The petitioners have not shown how these provisions violate the constitution; we therefore hold that these changes are governed by policy and do not violate the constitution.”

The bill is aligned with the government’s objective to generate additional funds to finance its proposed budget of Sh3.6 trillion for the financial year 2023/2024.

editor@igamingafrika.com