Fidelity Bank Announces Official Partnership with NLA to Transform Ghana’s Lottery Ecosystem

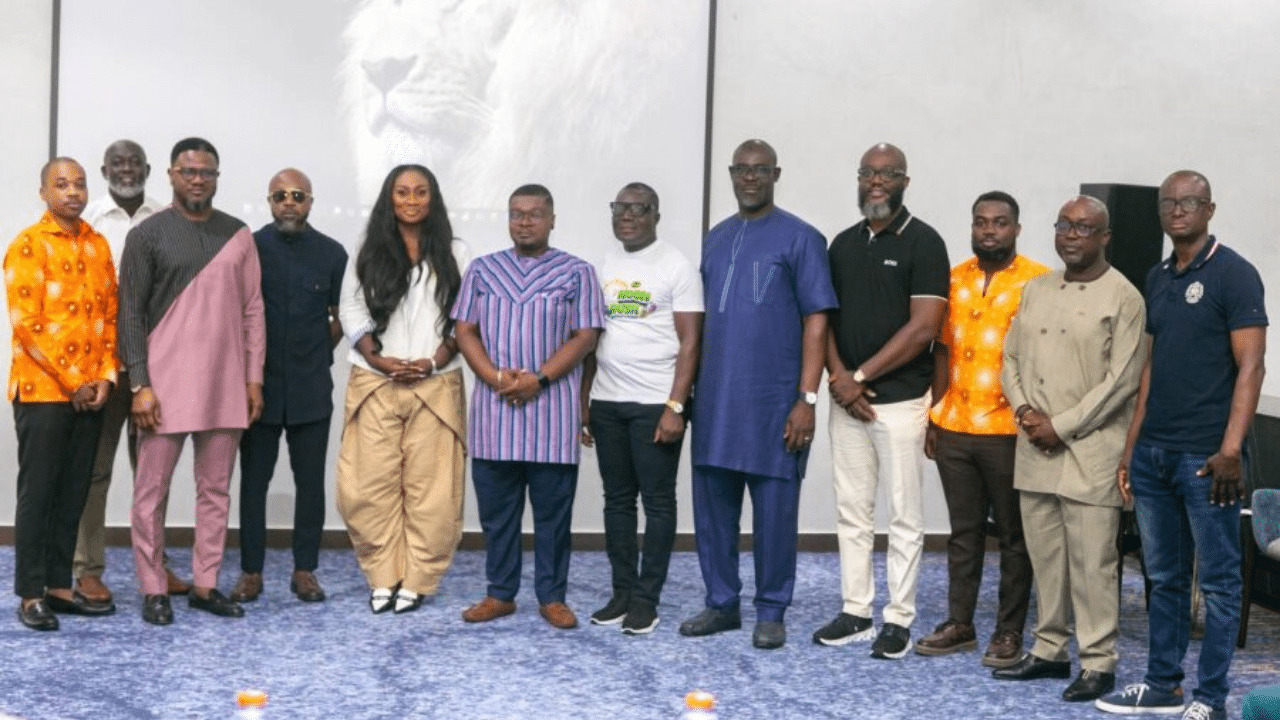

Fidelity Bank Ghana and the National Lottery Authority (NLA) announced a strategic partnership on February 10, 2026, aimed at modernizing Ghana’s lottery landscape.

The current lottery ecosystem faces significant challenges, including a high prevalence of unregulated markets, outdated infrastructure, and limited reach. These issues undermine transparency and hinder efforts to ensure fair play in lotteries. Addressing these problems requires modernizing regulatory frameworks and expanding digital access to create a more trustworthy and inclusive environment.

Mohammed Abdul-Salam, Director-General of the National Lottery Authority, highlighted the urgent need for transformation within the industry. “For several years, the NLA has faced operational and market challenges. The growth of illegal lottery operations has diverted substantial revenue that should support national development projects. At the same time, our infrastructure requires modernization to meet the expectations of today’s digital consumers.“

Through collaboration, the NLA aims to rebuild public trust and increase revenue via strategic initiatives. By leveraging Fidelity Bank’s technological expertise, the goal is to meet the expectations of today’s digital-first consumers who have already embraced digital financial services. Additionally, formalizing the industry will foster greater engagement, enhance transparency, and establish a sustainable, modern lottery system that benefits all stakeholders.

Read Also: World Lottery Association Visits Ghana to Consider Hosting the 2028 World Lottery Summit

To achieve these goals, the partnership will deploy several critical technological and operational upgrades. A modern digital platform will be introduced, supported by enhanced payment infrastructure to streamline transactions and improve overall efficiency. Furthermore, the rollout of 5,000 new Android-based Point of Sale (POS) terminals will significantly increase physical access points for players, making participation more convenient. To enhance the player experience further, the system will also introduce instant prize payouts for winnings below GHS 30,000, ensuring winners receive their funds promptly and fostering greater trust and satisfaction.

This partnership is poised to have far-reaching financial and social impacts, with forecasts indicating a tenfold growth in total deposits within the next three years. This surge in revenue is expected to fund national development by strengthening the NLA’s contributions to sectors such as education, healthcare, and infrastructure. Additionally, expanding digital and retail channels will empower stakeholders by creating new opportunities for agents and LMCs through simplified operational processes and increased sales volumes. Leveraging Fidelity Bank’s digital capabilities will also help drive financial inclusion by integrating a significant portion of the informal lottery market into the formal financial system.

This partnership represents a long-term commitment to building a transparent, efficient, and inclusive lottery system. As Divisional Director Division Director, Corporate and Institutional Banking at Fidelity Bank Ghana, John-Paul Taabavi noted, the collaboration is not just about technology; it’s about reclaiming a narrative and rebuilding an industry that ultimately belongs to the people of Ghana.

“Today marks an important milestone for two Ghanaian institutions coming together with a shared purpose. We are here to reclaim a narrative and rebuild an industry that belongs to the people of Ghana. This partnership creates a clear path toward growth, transparency, and renewed public confidence,” Taabavi said.