Kenya’s biggest telco, Safaricom, has secured an insurance licence from the Insurance Regulatory Authority (IRA), concluding a four-year wait.

The company plans to launch insurance services for its M-Pesa users with a new product, Bima, as announced by CEO Peter Ndegwa during Thursday’s H1 2024 earnings call. Since 2020, Safaricom has been experimenting with insurance services, anticipating regulatory approval.

The introduction of Bima aligns with Safaricom’s strategy to expand M-Pesa into a comprehensive financial service provider that caters to its customers’ “digital needs.” With over 30 million active M-Pesa users transacting more than $11.6 billion (Sh1.5 trillion) monthly, Safaricom aims to leverage this vast user base to enhance its offerings in unit trust, savings, and insurance.

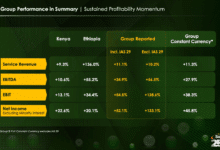

In H1 2024, Safaricom reported notable growth, with group service revenue increasing by 13.1% to reach Sh179.9 billion, and Earnings Before Interest and Taxes (EBIT) growing by 1.8% to Sh42.2 billion for the six months ending September 30, 2024. This strong performance is largely attributed to the success of its Kenyan operations, where service revenue grew by 12.9% to Sh177.5 billion, resulting in an 18% increase in EBIT to Sh79.2 billion and a 14.1% rise in net income to Sh47.5 billion.

“Innovation remains critical. We have revamped our wealth proposition and have now received an insurance intermediary license from the Insurance Regulatory Authority,” Ndegwa stated. “This will help us accelerate our rollout of insurance solutions; we expect to rollout propositions in both wealth and savings but also insurance in the second half of this financial year.”

Read Also: Aviatrix lands in the Netherlands

Safaricom’s growth has been supported by its expansion into Ethiopia, where its customer base grew by 47.3% to reach 6.1 million monthly active users. The data usage per user in Ethiopia stands at 6.6GB, significantly higher than Kenya’s 4.1GB. Adil Khawaja, Safaricom’s Board Chairman, expressed satisfaction with the results, highlighting the company’s vision of becoming Africa’s leading purpose-led technology company.

Key financial highlights include M-Pesa revenue of Sh77.2 billion, reflecting a year-over-year increase of 16.6%, contributing to 42.9% of the total revenue. The mobile connectivity segment, including voice, data, and SMS, accounted for 52.2% of the total revenue at Sh93.9 billion.

The telco’s plans to enhance financial services on the M-Pesa platform have faced challenges, such as regulatory pressure from the Central Bank of Kenya to restructure its mobile money unit. Despite this, Safaricom has continued to grow, with a total customer base reaching 52 million after a 7.8% increase year-over-year, and active M-Pesa customers climbing to 40.9 million.

Overall, Safaricom’s strategic expansion into insurance and other financial services is poised to harness its robust customer base while addressing the need for increased financial inclusion in Kenya, where insurance penetration remains at just 3%.