Pulsebet shutting down amid 30% new tax on betting regulation in Uganda

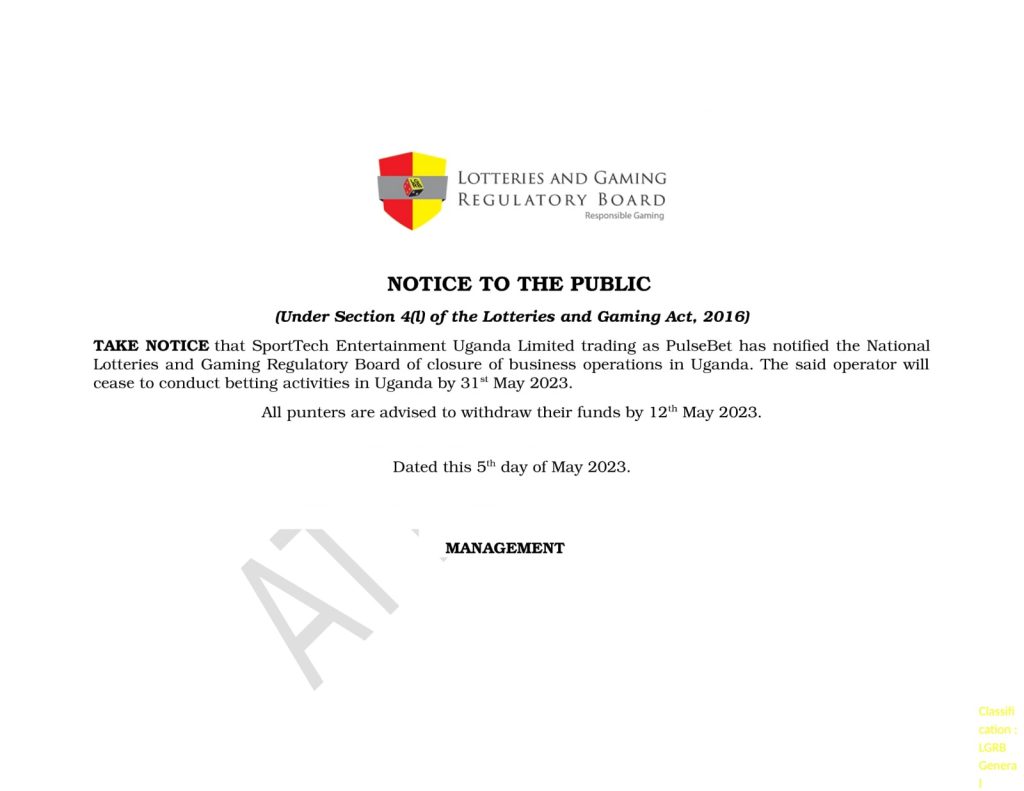

Pulsebet, a popular betting site in Uganda is shutting down its operations in the country. According to SportingTech, Pulsebet’s closure of operations in the country was reported to the National Lotteries and Regulatory Board of Uganda. pulsebet betting site uganda

The company belonged to SportingTech Entertainment Uganda being one of the company’s subsidiaries.

The regulatory body stated on May 8 that “the said operator will cease to conduct betting activities in Uganda by May 31st, 2023,” adding that “all bettors are advised to withdraw their funds by May 12, 2023.” in a notice seen by igamingafrika.com

Why Pulsebet decided to quit conducting business in Uganda is still unknown. However, the development occurs at a time when gambling enterprises are lamenting intolerable taxes. It is therefore believed that this might have been the motivating factor behind the move by Pulsebet to quit the market.

Not so long ago, Sports Betting Africa (SBA) shut down its physical locations nationwide in 2021 and switched to an online-only business model, claiming an unfriendly tax climate, limitations brought on by the Covid-19 pandemic, and an overwhelming amount of competition.

While submitting a report on the Bill on Thursday, May 4, 2023. The Deputy Chairperson of the Finance Committee, Hon. Jane Pacutho, stated that the 20% tax rate on sports betting will be retained. Read more about the new taxation development here

She further stated that some games such as roulette, poker, and slots have multiple start and stop points within them, making it difficult to enforce the tax point for winnings.

Consequently, casinos are instead using the end of day reconciliations to account for withholding tax which would only be on the days when they have made losses. Such an occurrence is highly unlikely for a casino because betting/gaming companies are always winning.

reads the committee report in part. pulsebet betting site uganda

Read More: Sports Betting East Africa+ Summit (SBEA+) to take place in Uganda – Eventus International

The committee stressed the need to change the law so that taxes are only levied on winnings and not on amounts wagered.

To plug this revenue leakage, the measure proposes to remove the 15 per cent withholding tax on payments for winnings of gaming and instead increase the gaming tax to a rate of 30 per cent across the gaming sector.

Pacutho said.

The Lotteries and Gaming (Amendment) Bill, 2023, which will increase the existing tax on gaming activities from 20% to 30% under current law, was approved by Parliament last week.

Clause 48(1) of the Lotteries and Gaming Act, 2016 states that ‘an operator of a casino, gaming or betting activity issued with a license under this Act shall, in addition to taxes prescribed by law, pay a gaming tax at the rate prescribed in Schedule 4’.

Schedule 4 of the existing law prescribes the rate of tax as 20 percent of the total amount of money staked, less the payouts/winnings, for the period of filing returns.

In order to properly regulate the sector and safeguard the populace from illegal gambling operations, the Ugandan government has also recently been strictly monitoring the now extremely lucrative gambling industry. This has included cracking down on illegal gaming operators operating in the nation.

Subscribe to our channel on Telegram here for timely live updates on all happenings in the iGaming space in Africa. You may also join our group on Telegram here and grow your networks by interacting with all players in the iGaming sector in Africa. pulsebet betting site uganda