Nigeria Federal Government Recommends Sports Betting Tax Scheme Plan

The Nigeria Federal Government is proposing to introduce a sports betting industry tax scheme in the country. Betting Tax Scheme Nigeria

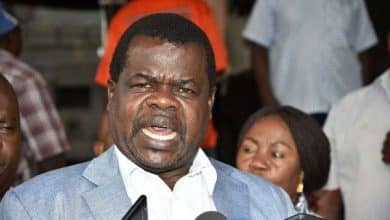

This was said by Bello Maigari, the executive secretary of the National Lottery Trust Fund (NLTF), during the National Lottery Regulatory Commission’s ongoing biennial national gaming conference, which was held in Lagos for its second edition.

According to Bello Maigari, despite the nation’s economic struggles, Nigerians stake billions of dollars annually and there has been an exponential growth in the online sports betting business in Nigeria.

As of my last knowledge update in September 2021, the global online betting market was estimated to be worth over $50 billion, and it has continued to grow significantly since then.

In Nigeria, the online betting sector has seen exponential growth, with millions of citizens engaging in various forms of online gaming and betting.

With a population of over 200 million people and the largest betting market in Africa, our country is making giant strides in the world of online sports betting.

Currently, there are over 65 million Nigerians actively engaging in this activity, spending 15 USD on average every day. It is on record, each day, 14 million bet takes and payments are made online in our country.

Bello Maigari, Executive Secretary National Lottery Trust Fund

Read Also: Introducing the nominees for the 2023 Games Industry Africa Awards (GIAA)

According to Maigari, by the end of 2023, Nigeria’s revenue from the internet betting industry alone is expected to surpass $256 million and it is anticipated to rise at a rate of around 10% each year and reach more than $366 million by 2027.

Maigari also urged the Federal Government to establish a framework that would motivate the Nigerian sports betting sector to begin filing taxes.

Moreover, leveraging the gaming and betting industry as a tax contributor can help create a level playing field for both local and international operators,” he said.

By establishing clear and equitable tax regulations, we can encourage foreign players to operate within our regulatory framework, ensuring that we benefit from their presence whilst safeguarding our citizens.

The importance for taxation of this sector cannot be over-emphasized.

Bello Maigari