Nigeria iGaming market overview: #1 in Africa

Nigeria is Africa’s largest iGaming market and one of the fastest-growing globally. With a CEB (Competitive Earning Baseline) of $658.9M and year-over-year growth of +61.1%, the market has entered a new phase of expansion, one fueled by 236,7 million people and a median age under 20. Blask tracks 174 active brands competing for 12.2M monthly acquisition opportunities, making Nigeria one of the continent’s deepest and most contested betting markets.

The story of Nigeria in 2025 is a regulatory reset. A landmark Supreme Court ruling in November 2024 declared the National Lottery Act unconstitutional, stripping the federal regulator (NLRC) of nationwide authority and handing gambling oversight to individual states.

Despite this upheaval, regulation is working: nine out of ten top brands hold local licenses, and the market remains orderly. At the same time, demand is extraordinarily concentrated, the top 10 brands command over 99.9% of market power, leaving virtually nothing for the long tail.

Blask metrics overview

Blask Index — real-time measure of market demand volume for iGaming brands in a given country, based on normalized search data.

BAP (Brand’s Accumulated Power) — a brand’s percentage share of total market demand in a specific country and period.

APS (Acquisition Power Score) — benchmark of how many new customers a brand should be attracting given its current market presence, expressed as a min/avg/max range.

CEB (Competitive Earning Baseline) — projected revenue a brand should realistically capture given its market presence, expressed in USD as a min/avg/max range.

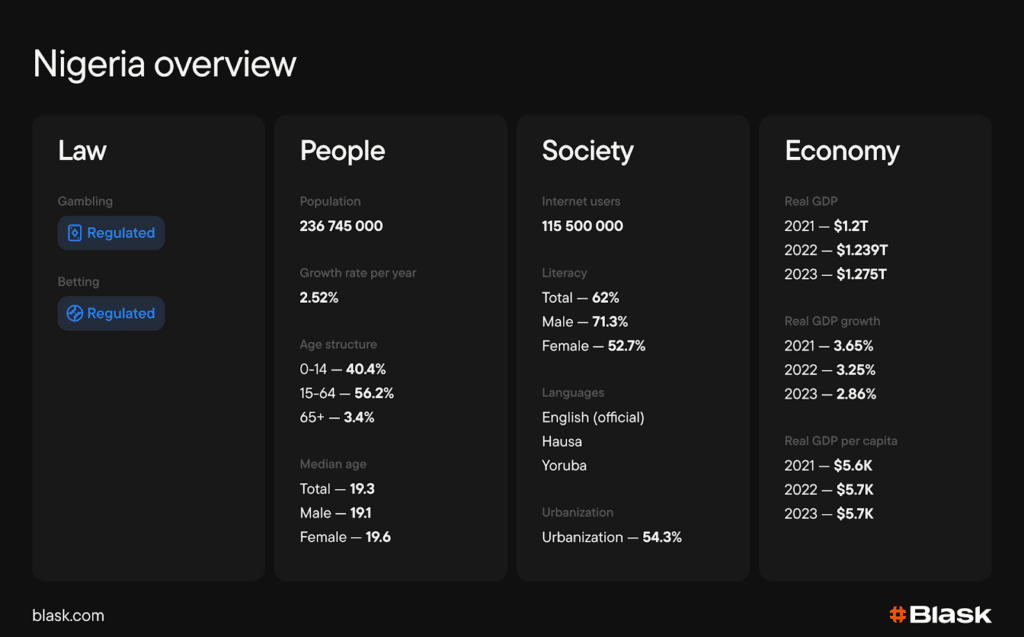

Macro snapshot

Nigeria’s 236.7 million people make it Africa’s most populous nation. Internet penetration almost reached 50% in 2025, with 115.5 million active users. Mobile accounts for over 86% of web traffic, making mobile betting the default entry point.

Regulation: Three-track licensing

Nigeria’s iGaming market is open and actively regulated. Almost every top brand operates with a local license, and the regulatory framework, though in flux, is functional. What’s changing is who controls it.

Key timeline:

- 2005 — National Lottery Act establishes the NLRC as federal gambling regulator.

- November 2024 — Supreme Court nullifies the Act. Gambling regulation shifts to exclusive state jurisdiction. NLRC restricted to the FCT (Abuja).

- 2025 — FSGRN introduces the Universal Reciprocity Certificate (URC) for multi-state licensing; 22 states join. NLRC launches Remote/Offshore Operator Permit (ROP) at $100,000/year. Central Gaming Bill reaches second reading, proposing federal control over online gambling.

- September 2025 — FSGRN approves unified tax: flat 11% GGR tax and ~$74K annual license fee per vertical, effective January 2026.

Read Also: Federation of State Gaming Regulators of Nigeria (FSGRN) Meets to Discuss Supreme Court Judgment Affirming State Jurisdiction Over Gaming Regulation

Tax stack for operators: 11% GGR (from Jan 2026), 5% excise duty on gaming services, 5% withholding on player winnings, 4.5% on offshore player deposits via Sentinel platform. The total effective burden can reach 15–20% when state and federal levies combine.

Three licensing paths exist today: URC through FSGRN (most stable, 22 states), NLRC’s ROP (legally contested beyond FCT), and individual state licenses (e.g., Lagos LSLGA at ~$37K). The NLRC has recovered ~5,9M in previously uncollected taxes through its Sentinel monitoring platform.

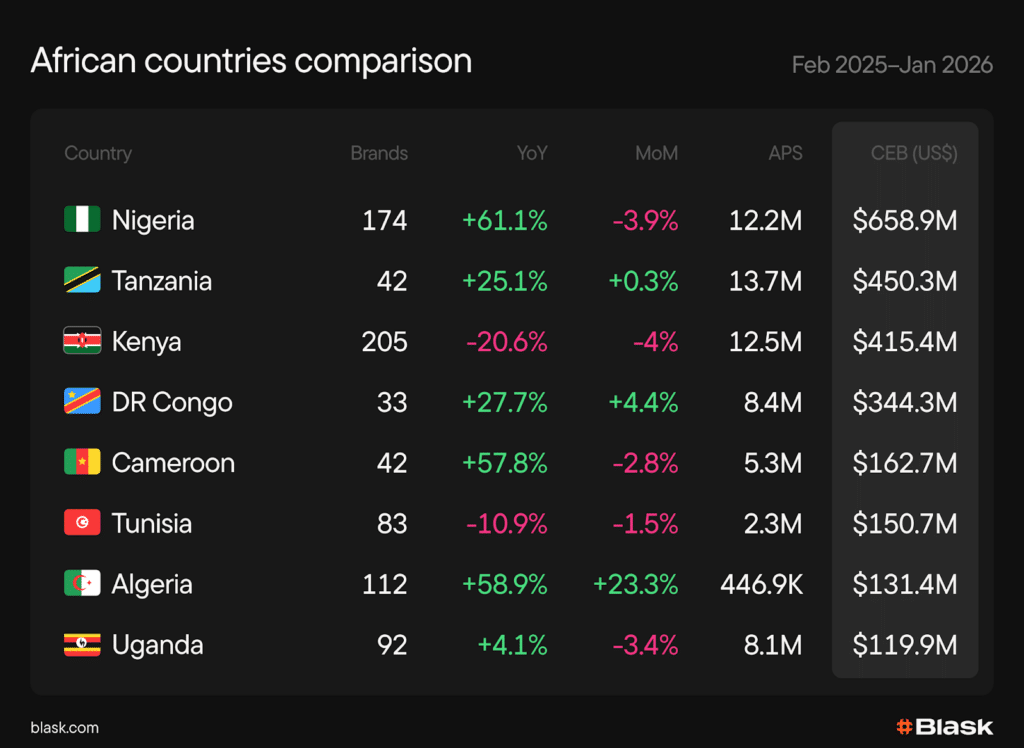

Africa’s #1 market

Nigeria ranks #1 in Africa by CEB ($658.9M), ahead of Tanzania ($450.3M), Kenya ($415.4M), and DR Congo ($344.3M). Its +61.1% YoY growth is the strongest among leading African markets — Kenya contracted, while Tanzania, DR Congo and Cameroon all grew, but at a lower rate.

Despite leading by revenue, Nigeria is not the most crowded market on the continent — Kenya has 205 active brands to Nigeria’s 174 (out of 203 tracked by Blask), suggesting room for more operators if they can crack the competitive barrier.

Market dynamics: Explosive growth

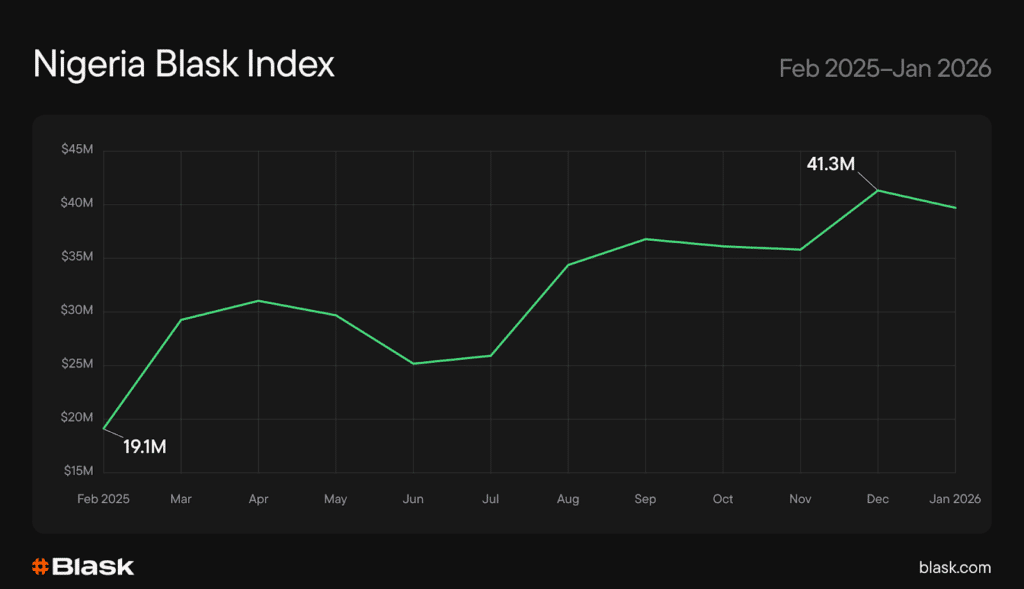

Blask Index more than doubled over 12 months, rising from 19.1M (Feb 2025) to 39.7M (Jan 2026) — a +107% increase. The trajectory shows three phases:

Feb–Apr: Spring climb. Blask Index rose as the European season hit its decisive stretch — Champions League knockouts, Premier League title race.

Jun–Jul: Summer dip. Blask Index fell as European leagues entered off-season. Nigerian bettors — overwhelmingly football-focused — reduced activity.

Aug–Jan: Football surge. The 2025/26 Premier League launch pushed Blask Index up in August. It peaked at 41.3M in December, coinciding with AFCON 2025 in Morocco, where Nigeria’s Super Eagles advanced to the semi-finals before losing on penalties to the hosts.

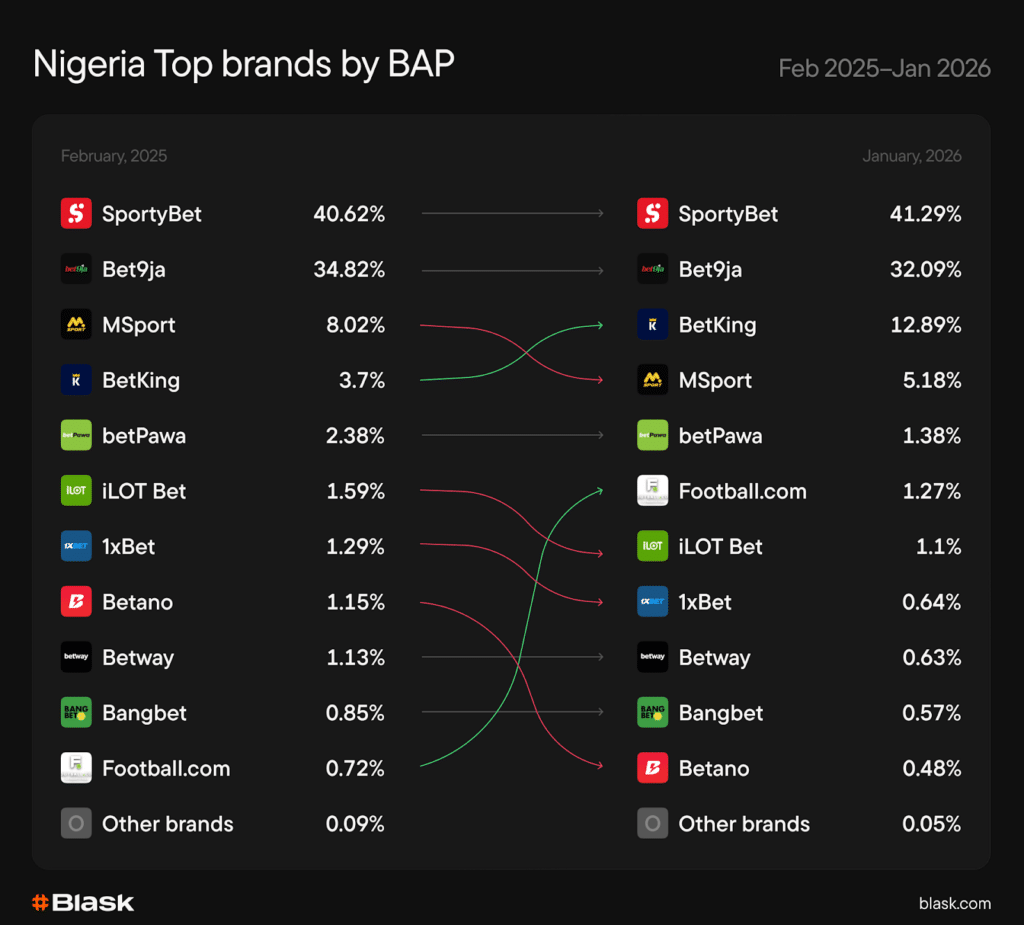

Competitive landscape: Duopoly + breakout stories

Nigeria’s market is a clear duopoly – SportyBet and Bet9ja together hold 73.3% of BAP. The breakout story is BetKing. With +296.4% YoY growth, it claimed the #3 position — the most explosive rise among top-10 brands. Another standout is Football.com, which grew +366.4% YoY to reach #6.

Meanwhile, globally recognized brands are losing ground: 1xBet, Betway, and Betano all saw their BAP shares decline over the period, ceding position to locally focused competitors.

The long tail is virtually nonexistent: “Other brands” hold 0.05% BAP. The top 10 command over 99.9% of market power — and of those ten, only iLOT Bet operates without a local license. For new entrants, the barrier is less regulatory than competitive.

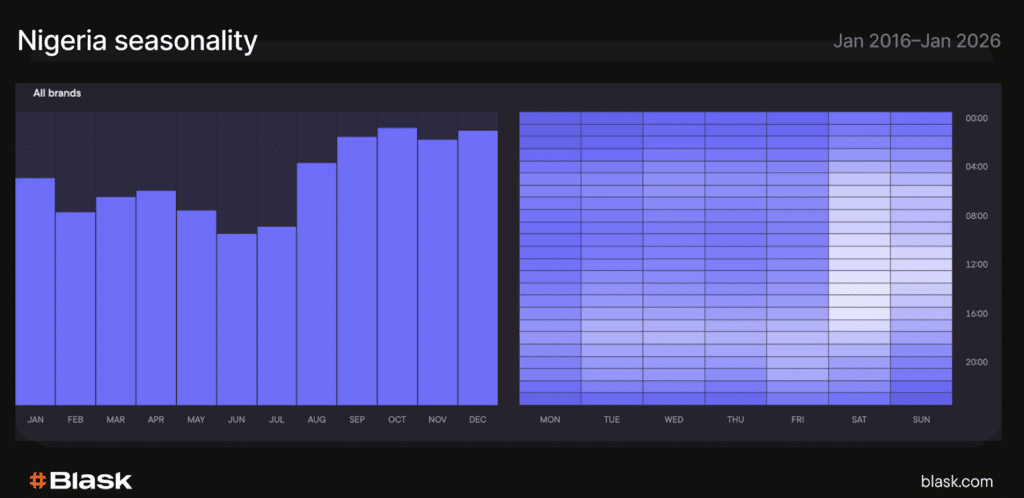

Seasonality: Follow the football calendar

Peak months are September through December, when the European domestic season is at full pace alongside Champions League group stages. January stays high — historically boosted by AFCON editions and the Premier League winter schedule. The weakest window is June–July, when European leagues enter off-season and Nigerian bettors — overwhelmingly football-focused — reduce activity. Blask Index fell 17% from May to June in 2025.

Weekly patterns are clear: Saturday is the peak day, driven by the full Premier League matchday slate and accumulator betting culture. Activity stays elevated through Sunday and tapers off early in the week before building again toward the weekend.

Conclusion

Nigeria’s iGaming market is open, fast-growing, and heavily concentrated. A $658.9M CEB and +61.1% YoY growth make it the continent leader, yet nearly all player attention flows to just ten brands — nine of them locally licensed.

That concentration looks daunting, but it’s not permanent. BetKing’s leap from 3.7% to 12.9% BAP in a single year and Football.com’s +366% YoY surge prove that breaking into the top tier is still possible with the right product and marketing investment. Nigeria rewards operators who move fast in a market where 236.7 million people are increasingly online — and increasingly betting.

About Blask

Blask is an AI-powered platform for iGaming and gambling market analytics. The company turns fragmented open-source signals into real-time insight on brand visibility, player demand, and baseline revenue metrics, helping teams move first, spend smarter, and reduce risk across global markets.