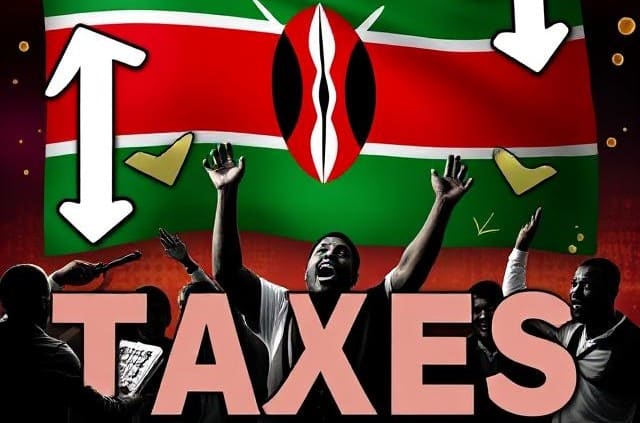

Kenya Announces Significant Reduction in Betting and Gaming Taxes

The Kenyan government has announced a substantial reduction in taxes applicable to betting activities, effective from July 1, 2025. One of the most notable changes is the reduction of the Excise Duty on betting and gaming from 15% of the amount wagered or staked to just 5% on the amount deposited into a customer’s wallet.

The announcement clarifies, “Following the enactment of the Finance Act, 2025, Excise Duty on betting and gaming has changed from 15% of the amount wagered or staked to 5% on the amount deposited into a customer’s wallet effective 1st July 2025.” This adjustment is expected to lower the cost burden on bettors, encouraging more active participation in betting activities.

Additionally, the government has revised the withholding tax on winnings. Previously set at 20% of net winnings, this has now been reduced to 5% on withdrawals made by punters. The announcement states, “Further, Withholding tax has changed from 20% in respect of net winnings to 5% in respect of withdrawals made by punters effective 1st July 2025.”

Read Also: SOFTSWISS Report: South Africa’s Gambling Revenue to Hit €3.63 Billion by 2025

The new rate applies to the amount withdrawn from a customer’s betting or gaming wallet maintained by licensed operators, which the announcement defines as, “the amount of money withdrawn by a customer from their betting or gaming wallet maintained by a person licensed under the Betting, Lotteries and Gaming Act.”

The reduction in these taxes is anticipated to stimulate increased activity within the industry, providing a more favorable environment for operators and punters alike. Industry stakeholders are encouraged to adapt swiftly to these changes to maximize their benefits. The move is set to invigorate the betting and gaming industry in Kenya.