Kenya’s Government Moves to Curb Youth Betting Addiction with Increased Excise Duty

The Kenyan government has announced a significant proposal to increase the excise duty on gaming and betting to 20% in an effort to discourage young people from engaging in the practice. Kenya

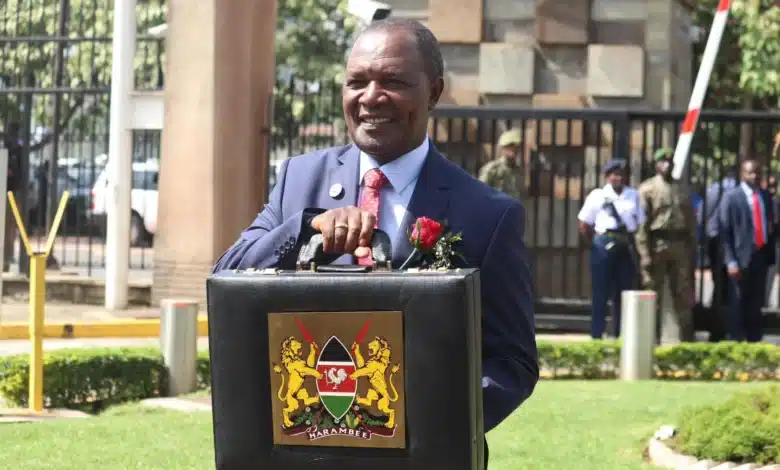

The move came under the 2024-25 Budget presented by CS Njuguna Ndung’u before the National Assembly on Thursday evening.

The Treasury Cabinet Secretary during the session read a sh 3.9 trillion budget highlights and a raft of revenue-raising measures for the 2024–25 financial year. The increase in excise duty on gaming and betting is part of the Finance Bill 2024 proposals.

According to the proposal, the excise duty on gaming and betting will be raised from the current 12.5% to 20%.

The move to raise excise duty on gaming according to the treasury cabinet secretary is aimed at addressing the growing concern of betting addiction among young people most especially school going children. Kenya’s excise duty on gaming has increased significantly over the past two years, rising from 7.5% to 12.5% and now standing at a staggering 20%.

Read Also: Win a Mercedes-Benz G-Class in Megapari’s EURO MEGA DRIVE!

The government believes that increasing excise duty will help reduce the appeal of gaming and betting to young people, who are often attracted to the instant gratification and thrill of winning. Kenya Betting Excise Duty 20

“Participation in betting, Gaming, price competition, lotteries continues to affect social economic fabric of our society given their addictive nature,” said the cabinet secretary. “To further discourage this behavior, I propose to increase the excise duty tax rates to 20%.”

However, some stakeholders in the gaming and betting industry have expressed concerns about the proposal. They argue that increasing excise duty will lead to a decline in their businesses and potentially result in job losses.

“How comes the government moves from 7.5 exercise duty to 20% within 2 years? Isn’t that like 266% increment within 2 year?” said a representative from a gaming company.

Following the announcement by the cabinet secretary, iGaming AFRIKA spoke with a number of industry players who generally have expressed their concerns on the tax increase as a strategic effort by the government to tap into the lucrative gambling industry, which is one of the country’s top revenue earners. According to them, the increased tax rate aims to generate additional revenue for the government, and this is likely to have a significant negative impact on the gaming sector in Kenya.

Copyright 2024: Media-Tech iGaming Technology Limited. Permission to use quotations from this article is granted subject to appropriate credit being given to www.igamingafrika.com as the source.