Kenya has taken a cautious approach to digital currencies, recently launching an investigation into the operations of Worldcoin, an iris biometric cryptocurrency that paid Kenyans to collect their eyes’ biometrics. Kenya Money Laundering Crypto Betting

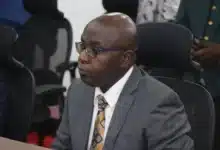

Kithure Kindiki, the Interior Cabinet Secretary, told Parliament’s ad hoc committee that such cryptocurrencies are a weak link for money laundering.

Because cryptocurrency is not a legal tender and because it does not fall within the regulatory armpit of the CBK, it is very difficult to oversight that trade.

said Prof Kindiki.

The state has already tightened checks on betting firms by first canceling their licenses and asking them to apply afresh under tightened oversight.

The government designated sports betting as a high-risk area for money laundering, noting that winnings from sports betting could be paired with funds from underlying crimes and passed out as genuine winnings, with possible collusion on who takes the winnings, which are then either reverted to the syndicate or transferred outside the country. Kenya Money Laundering Crypto Betting

The Kenya Revenue Authority has now integrated its systems with those of betting companies, providing it with a real-time view of money flow for tax purposes.

Read Also: Kenya Targets Betting, Banking, and Money Remittance Platforms Amid Fight against Dirty Cash

The government is now making another attempt to get lawyers to report questionable transactions by their clients to the Financial Reporting Centre (FRC), which would be a significant step forward in the fight against money laundering.

The FRC reached an agreement with the Law Society of Kenya last month to become a self-regulatory body, allowing attorneys to report on proceeds of crime and anti-money laundering.

Under the Ownership Information Regulations of 2020, authorities have also made efforts to ensure that corporations disclose the identification of hidden shareholders, including names and residence addresses.

The Business Registration Service (BRS), a state body in the Attorney General’s office that oversees the process, is advocating for changes in the legislation that would allow it to penalize corporations that fail to make such disclosures.

According to the National Treasury, BRS has been conducting outreach initiatives to remind enterprises of their obligations, including the filing of beneficial ownership information, and will begin deregistering all non-compliant firms.

Allowing beneficial owners to conceal their identities has allowed individuals to amass vast fortunes by laundering criminal proceeds through proxies who obscure and disguise the source of monies used to buy the assets involved.

Kenya is eager to completely integrate with the Financial Action Task Force (FATF), the worldwide watchdog on money laundering and terrorist funding, and the Eastern and Southern Africa Anti-Money Laundering Group (ESAAMLG), a FATF associate member.

Over 200 jurisdictions around the world have agreed to the FATF guidelines, which include requiring financial institutions to conduct customer due diligence on transactions exceeding the predefined threshold of $15,000 or €15,000 (Sh2.4 million). Kenya Money Laundering Crypto Betting